Medicare Advantage

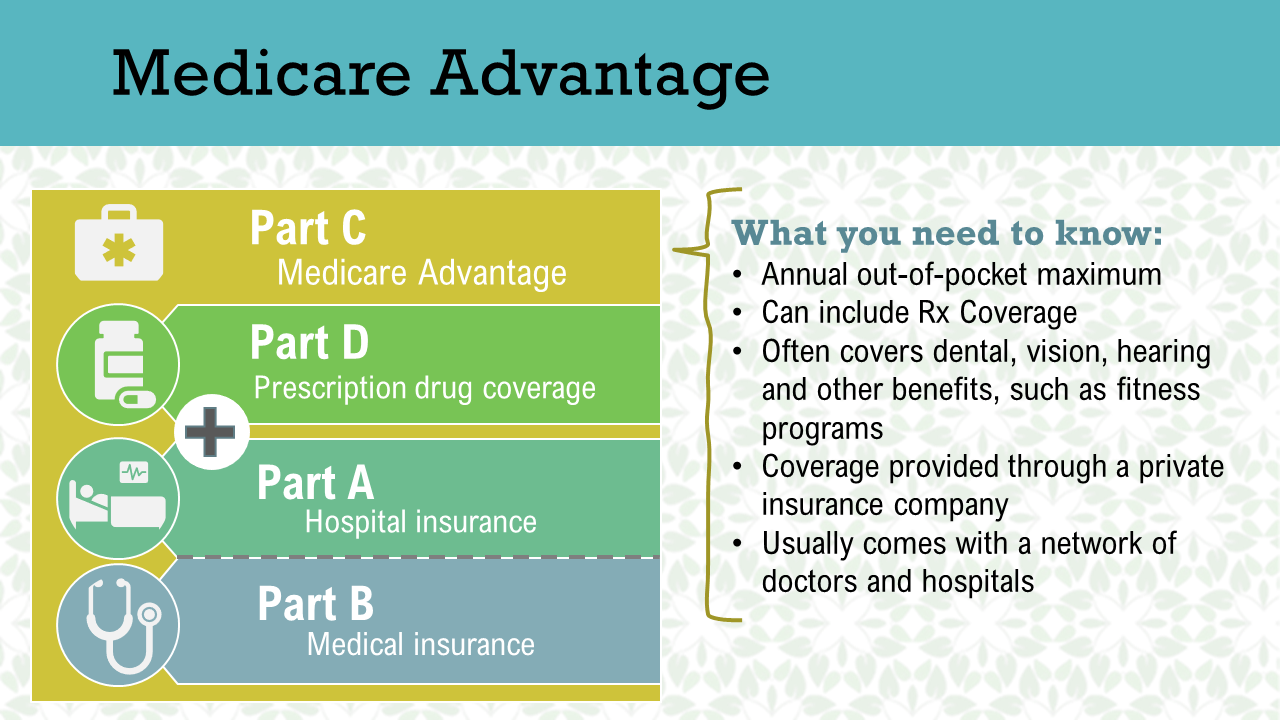

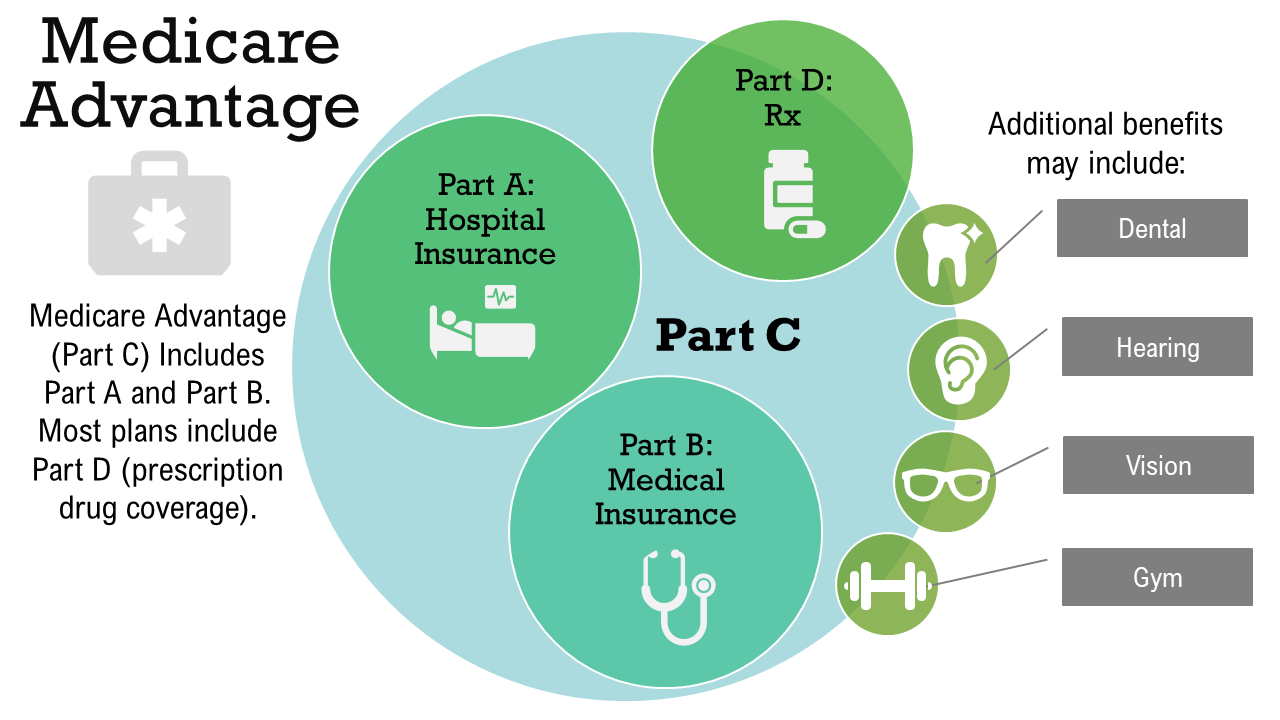

Sometimes referred to as Medicare Part C, this program was designed by the government to give Medicare beneficiaries a lower-premium option than what Medigap offers. These plans also provide a coverage option for people who missed their Open Enrollment Window for Medigap and now cannot qualify for Medigap due to health conditions.

Advantage plans are very different from Medigap plans. A Medicare Advantage plan is a private Medicare insurance plan that you may join as an alternate way to get your Medicare benefits. When you do, Medicare pays the plan a fee every month to administer your Part A and B benefits. These Medicare private insurance plans usually have an HMO or PPO network of doctors. With these networks of doctors, Medicare Advantage provides a lower cost plan with just one health question.

What to consider:

- You must stay enrolled in Medicare Parts A and B.

- Your plan will offer all the same services as Original Medicare, such as doctor visits, surgeries, lab-work.

- You must continue to pay your Medicare Part B premium while enrolled in an Advantage plan.

- You must live in the plan’s service area.

- Most Advantage plans include a built-in Part D drug plan.

- Premiums are usually much lower for Advantage plans due to use of network doctors and facilities.

- The premiums, copays, benefits, and drug formularies can and do change from year to year. This stems from the fact that Medicare Part C plans must renew their contracts with Medicare annually.

Additional Medicare Advantage Information

Medicare Advantage Plans include the following:

Health Maintenance Organization (HMO) Plans

In most HMO Plans, you can only go to doctors, other health care providers, or hospitals on the plan's list except in an emergency. The insurance company contracts with certain doctors in your local area to form a network. You will select a primary care physician (PCP) who will coordinate your care. You may also need to get a referral from your primary care doctor to see other doctors or specialists. Medicare Part D(prescription drugs plans) are included in many HMO plans. You should always check the plans formulary to ensure your medications are included. Keep in mid you must live in the plan's service area.

Often times there are annual changes which occur regarding the benefits formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance. The changes occur on January 1st of each year. It's important to know and understand these changes by reviewing your plan from year to year via the Annual Notice to Change Letter which you will receive each September.

If a Medicare HMO seems too restrictive you can also consider a Medicare PPO which has more flexibility.

Preferred Provider Organization (PPO) Plans

A Medicare PPO Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. In a PPO Plan, you pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network. You pay more if you use doctors, hospitals, and providers outside of the network. You are not usually required to pick a primary care physician. You will have more freedom to see out-of-network doctors at a higher cost. Usually Part D(prescription drugs) benefits are included in the plan. Some plans include extra benefits such as vision exams and discounted gym memberships.

Often times there are annual changes which occur regarding the benefits formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance The changes occur on January 1 of each year. It's important to know and understand these changes by reviewing your plan from year to year via the Annual Notice to Change Letter which you will receive each September.

Private Fee-for-Service (PFFS) Plans

A Medicare PFFS Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care. The thing that makes these plans different form an HMO and PPO is that you are not limited to any certain network of providers. Instead, you would just present your PFFS ID card to the provider before seeking medical treatment and the provider must accept the plan's terms and conditions and then bill the plan. This plan feature makes it more popular with Medicare recipients who like to travel. You can get a plan with a built in drug plan or one with that is for "medical only".

Medicare Special Needs (SNP) Plans

Medicare SNPs are a type of Medicare Advantage Plan (like an HMO or PPO). Medicare SNPs limit membership to people with specific diseases or characteristics, and tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve. Find out who can join a Medicare SNP.

With a Medicare Advantage Plan you will use the plan's local network of providers. Some plans have a $0 monthly premium, but you will still need to pay your Medicare Part B premium. As you use your doctors' services, you will be billed for the co-payments. Keep in mind that each plan has set its own cost-sharing.

Advantage Plans were built with an out-of-pocket maximum cap on your medical spending. This is thought of as your safety net. For 2023 this cap is set at $8,300 and this applies to all in (out) of network Medicare Part A and Part B eligible cost sharing.

Most times the Advantage plans include a built-in Medicare Part D drug plan and the drug costs do not count toward the out of pocket cap of $8,300. Please see Prescription Drug pricing.

Medicare Advantage vs Medigap – how do you choose?

As you may know by now, Medicare alone doesn’t cover everything. Most people buy additional insurance to bridge the gaps. When considering Medicare Advantage vs Medigap plans, it’s important to understand that both types of plans will help reduce your out-of-pocket spending.

After all, who wants to come up with a deductible each time you enter the hospital? Or pay 20% of the cost of an expensive MRI?

The two main types of coverage that you can buy to help with this are Medicare Advantage and Medigap (Medicare Supplement). It’s important that you know how each type of coverage works, so that you can select the right plan.

Medicare Supplements

Medicare Supplements pay as a secondary insurance to Medicare itself. This means they pay after Medicare first pays its portion of the bill. You stay enrolled in Original Medicare, and Medicare sends the remainder of your bills to your Medicare supplement company. Then the supplement company pays its share according to which plan you are enrolled in.

You can see any provider that participates in Medicare, regardless of which supplement company you choose. You have access to all Medicare providers nationwide – no referrals necessary. If you enroll in a comprehensive plan like Plan F or Plan G, you will have very little out of pocket cost.

When you enroll, your Medicare supplement insurance company notifies Medicare that you have purchased a policy. Then, when Medicare pays its portion of your bills, it will automatically send the remainder of your bill to your Medicare supplement company. It’s seamless, with no claim forms for you to file.

Medicare Advantage

Medicare Advantage Plans on the other hand, are entirely separate from Medicare. When you enroll into a Medicare Advantage policy, you get your benefits from the plan, not Medicare. You agree to use the plan’s network of providers except in emergencies. You’ll pay copays for your health care treatment as you go along. These plans are an alternative to Original Medicare.

About 33% of beneficiaries choose to enroll into Medicare Advantage policies, which are private insurance plans. They usually have lower premiums than Medigap plan sometimes even a $0 premium on some plans in some areas.

When a plan has a $0 premium, it means that you will pay no additional premiums for the plan itself. You will still pay for your Part B premiums monthly. You must be enrolled in both Medicare Parts A and B to be eligible for a Medicare Advantage plan.

Why would any company offer a $0 premium plan? Because you agree to use the plan’s network providers to get your care. This means you’ll have substantially fewer doctors to choose from than if you chose a Medigap plan. The insurance company has more control over your choice of providers, with whom they negotiate contracted rates. Before choosing an Advantage Plan, check to see that your doctors are in the network.

Changing Between Medicare Advantage vs Medicare Supplement Plans

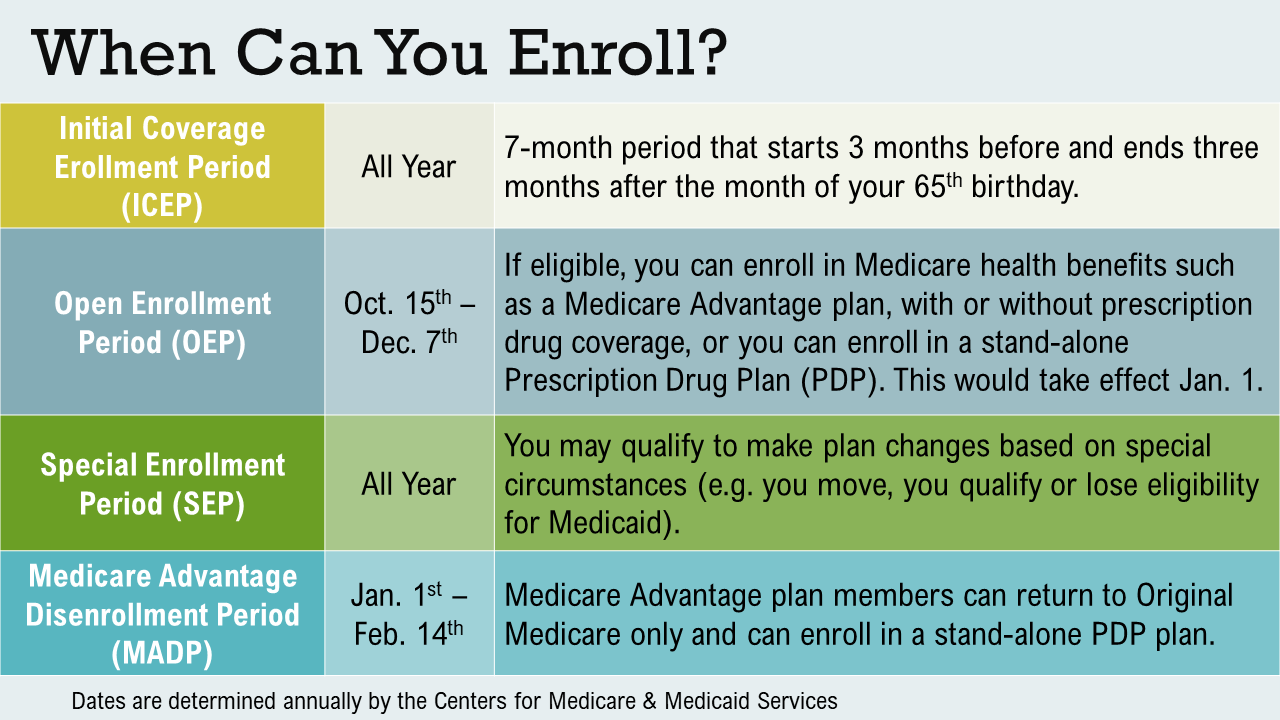

Many people wonder if they can start with Medicare Advantage and change to Medigap later if they get sick or need more coverage. It does not work that way. If you leave a Medigap plan to go on Medicare Advantage coverage instead, you may not be able to get back into a Medigap plan later.

Can I change from Medicare Advantage to Medigap?

You might be outside of your one-time initial enrollment window by then, and that means Medigap plan insurance companies can ask health questions on your application. The insurance carriers can decline you for certain health conditions or even medications that you take, so be aware of this before changing to Medicare Advantage.

An exception: There is a trial period for people who try Medicare Advantage for the first time. If you decide to dis-enroll from the plan and go back to Original Medicare within the first 12 months of Medicare Advantage coverage, then you can return to your Medigap plan with no underwriting. After the 12 months is up, then you are subject to underwriting.

Some of the key factors for comparison are:

- Monthly premiums

- Deductibles, if any

- Expected costs of healthcare services on each plan

- How often you use healthcare services

- Areas where you will need access to care

- Expected copays for your medications

- Potential out of pocket spending for you on each plan type

Seem overwhelming? Have The Medicare Solutions Group team help you in your search with doctor networks and drug formularies to come up with the ideal plan for you.

Get In Touch With Us

No matter what, we're here to help. Send us a message and an experienced agent will be in touch with you to help answer your questions.