Prescription Drugs

You can sign up for Part D Prescription Drug Plans starting three months before your 65th birthday.

It's important to do this on time because there's a permanent premium surcharge for enrolling more than three months after your 65th birthday if you don't have equivalent drug coverage from another source, such as a retiree plan.

Let us help you with your enrollment

If you are already enrolled in a Part D "standalone" plan or a Medicare Advantage plan that incorporates drug coverage, you can switch plans during the open-enrollment period, which runs from Oct. 15 to Dec. 7 every year with an effective date of January 1.

Your actual drug coverage costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s list of covered drugs or the formulary.

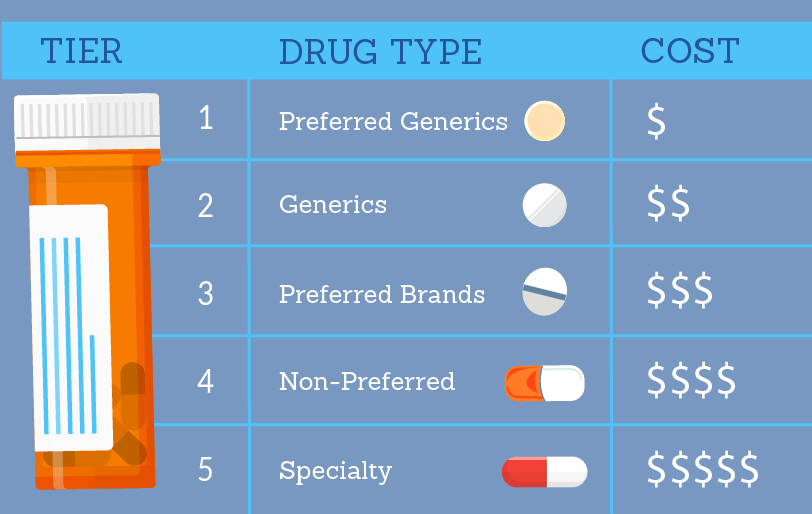

- What “tier” the drug is in.

- Which drug benefit phase you’re in (whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

- Which pharmacy you use (whether it offers preferred or standard cost sharing, is out of network, or is mail order). Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less.

- Whether you get Extra Help paying your drug coverage costs.

Note: Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin. You could pay no more than $35 for a 30-day supply. Find a plan that offers this savings on insulin in your state. You can join during Open Enrollment (October 15 – December 7, 2022).

Choosing a plan

It pays to review your Part D coverage every year, especially if you have started taking new drugs.

Contact The Medicare Solutions Group where you can find out about the basics of this benefit and various Part D plans. We can help you to compare offerings and coverage options in your area which include a helpful formulary finder. This formulary finder will allow you to compare plans based on the coverage of your personalized list of drugs. It will even show you your monthly out-of-pocket drug cost for the year.

Getting financial help

To qualify for Extra Help, your resources must be limited to $16,660 for an individual or $32,240 for a married couple living togther.

Download Medicare's instructions on applying for the Extra Help program.

Additional Information About Prescription Drug Plans

Medicare Part D is coverage for retail prescription drugs that you obtain from a retail pharmacy. This voluntary program allows you to access medications at a more affordable rate. It also provides insurance against catastrophic drug costs.

You do not enroll in Medicare Part D via Social Security. Instead, you will choose a Medicare Part D plan offered by a private insurance company in your state.

Medicare Part D costs include: a monthly premium that you will pay for the insurance itself, then there is cost-sharing that you will pay at the pharmacy for your medications and that cost-sharing may include some deductible spending if your Part D plan has a deductible.

Every insurance company sets its own formulary (list) of medications that are covered by the plan. Therefore, they can determine what monthly premium they will charge for the plan each year.

The cheapest Part D drug plan in your state is not always the best one for you. It’s important to choose the plan with a formulary that offers the medications you need. If you just enroll in the cheapest plan without checking the plan’s formulary, you may later learn that the plan does not cover one of your medications and you can’t change until the annual open enrollment.

Some people with higher incomes may have to pay more for their Medicare Part D plan. If you earned more than $91,000 filing individually or $182,000 filing jointly, then Medicare will also require you to pay extra for your Part D coverage. This is called the Income Monthly Adjusted Amount or IRMAA. You can read more about IRMAA costs here.

Medicare Part D Deductible

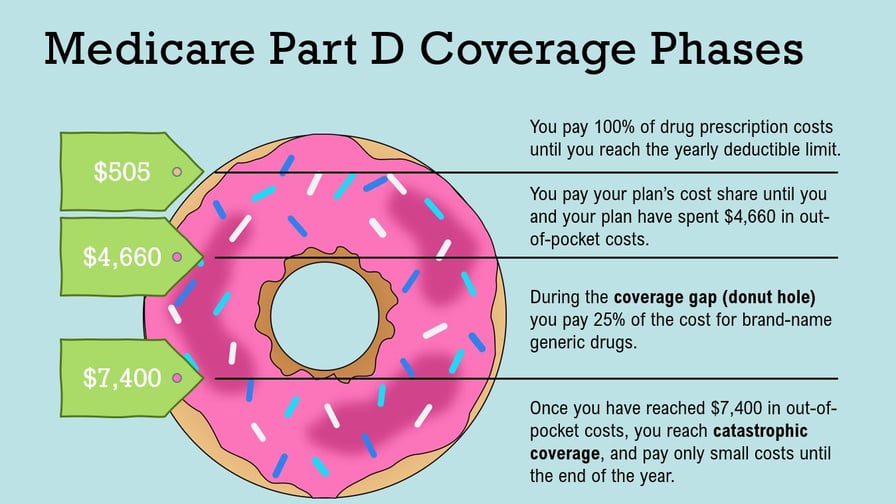

The Center for Medicare and Medicaid Services sets the minimum guidelines for Part D plans each year. Each insurance company offering Part D plans must follow these guidelines. All drug plans have 4 stages, and Medicare sets the threshold for each stage each year.

The first stage is the Medicare Part D deductible. In 2023, this deductible is $505. This means that each insurance company can require up to a $505 deductible from you up front before your benefits kick-in. The insurance company can also charge a lower deductible if it chooses to do so. However, no plan can charge a higher deductible than what Medicare allows for that year.

In general, the drug plans that charge the deductible up front will have lower monthly premiums and lower drug copays. Some companies waive the deductible, but then you will see that the premiums and copays are usually higher than plans that charge the deductible.

Medicare Part D Copays

Medicare Part D plans usually have 5 tiers for their medications in their formularies. A Tier 1 is usually a preferred generic medication. Tier 2 would be non-preferred generic. Tier 3 would be preferred brand and so on. The insurance company will set the copay for each tier. For example, one company might charge a $5 copay for Tier 1 medications, while another charges $7. This is why it’s important to review the plan’s formulary to make sure your medications are covered and to know what you can expect to pay for those medications.

When Do I Enroll in Part D?

You are eligible to enroll in Part D when you first get Medicare. This Initial Enrollment Period (IEP) lasts seven months. It includes the three months before you turn 65, your birth month, and the three months following. A similar window exists for people who first become eligible for Medicare due to disability.

Medicare Part D also has an annual election period which runs from October 15 – December 7. During this time, you can enroll or disenroll from any drug plan. This is because each Part D plan’s benefits, formulary, pharmacy network, provider network, premiums and/or co-payments/co-insurance may change on January 1 of the following year. Since many variables can change, Medicare gives you an annual election period to also change.

The insurance company will mail you an Annual Notice of Change each September. It will list everything that is changing with your plan for the following year. You need to review this information carefully to identify any changes or find another plan that is a better fit.

All Medicare Part D prescription drug plans have four stages. At the beginning of each year, Medicare announces how much money beneficiaries will have to spend to move through each coverage stage. These thresholds and the amount that beneficiaries pay in the gap changes annually in an effort to eliminate the gap.

Typically, once coverage begins at the start of the year, you enter the first stage of the Medicare Part D prescription drug plan known as the Deductible stage. Here, a Medicare beneficiary will be required to pay 100% of all prescription drug costs until the deductible is met. The deductible amount for 2023 is $505.

After you meet your deductible, you move to the Initial Coverage stage. In this stage, your plan will help pay towards your covered prescriptions. A Medicare Part D prescription drug plan beneficiary will pay a copayment or coinsurance and Medicare Part D will take care of the remaining balance of the drugs.

Once a beneficiary hits the $4,660 threshold, they enter what is known as the Medicare Donut Hole. While in the Donut Hole, a beneficiary will be required to pay 25% of all brand-name drugs.

The final part is referred to as the Catastrophic coverage stage – a stage that is reached once you have paid $7,400 in out-of-pocket costs for covered drugs. During this final stage of the Medicare Part D prescription drug plan, beneficiaries will be required to only pay a significantly lower copayment or coinsurance for their drugs, all the way until the end of the plan year. Once the plan year is over, all Medicare beneficiaries in the Part D prescription drug plan will revert back to the Deductible stage.

Get In Touch With Us

No matter what, we're here to help. Send us a message and an experienced agent will be in touch with you to help answer your questions.